My coffeehouse good friend, Steve Dakh of Ethereum Attestation Service fame, was trying to further educate me the other day about the differences between Ethereum and Bitcoin. He forwarded me this “The Bull Case for ETH” report from a week ago and I read it over and did a little bit of additional research. Here’s what I was able to learn in case you too would like to be able to distinguish between the top two cryptocurrencies.

I do not own any Ethereum or Bitcoin. Cryptocurrencies are all a LOT too new and speculative for me at the moment . . . maybe one day though. Ha!

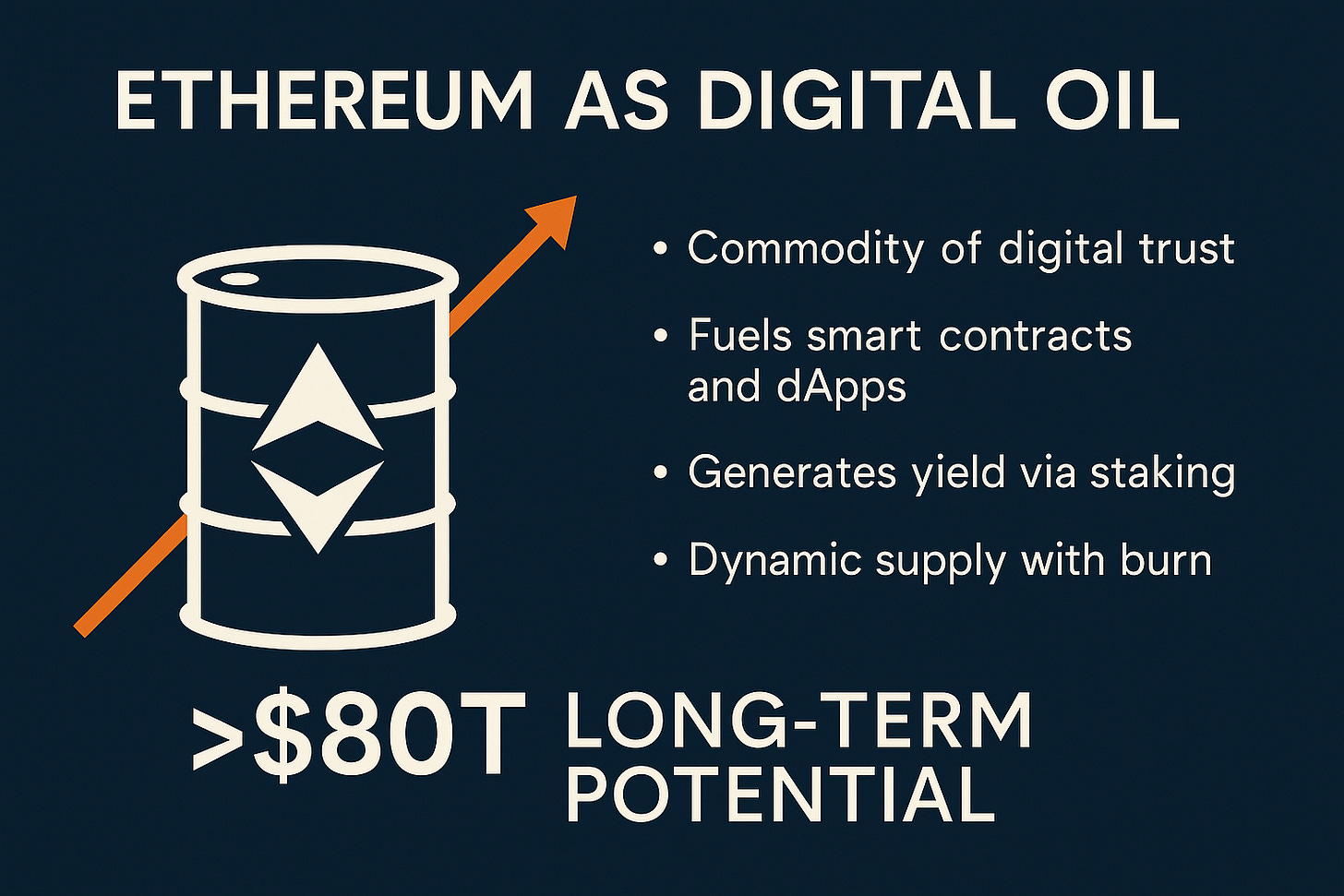

1. Framing ETH as "Digital Oil"

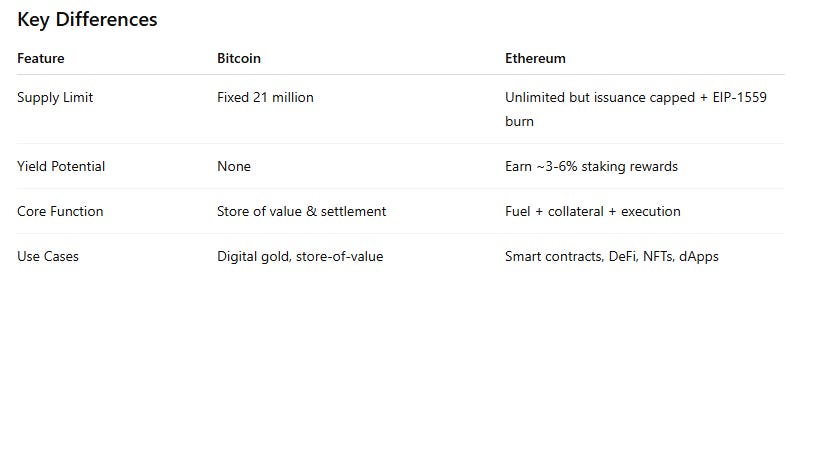

The report positions Ether (ETH) not merely as a speculative token or a digital asset akin to Bitcoin but as a foundational commodity that fuels the programmable economy, analogous to oil powering the industrial one. Critics once dismissed Ethereum as built on inflated narratives—gas fees, tokens, decentralized apps—but its authors reframe it as a commodity of digital trust. ETH underpins transactions on the Ethereum Layer-1 (L1) and all connected Layer-2s (L2), powers smart contracts, secures stake-based consensus, and serves as collateral and utility across DeFi, stablecoins, tokenized real-world assets, and emerging use cases like AI and identity.

Bitcoin, on the other hand, is usually framed as “Digital Gold.” It acts as a simple store of value with a fixed maximum supply (21 M BTC), no yield, and limited functionality beyond being money.

2. Economic Mechanics: Issuance, Burning, Staking

Ethereum’s economic design combines scarcity, productive use, and returns. New ETH comes into circulation via staking rewards and transaction fees, but much is burned under EIP‑1559. That burn mechanism dynamically reduces net issuance, creating a deflationary pressure aligned with usage. Meanwhile, staked ETH secures the chain and grants holders yield—unlike oil, which merely burns as fuel, ETH generates returns. Hence, it’s likened to a yielding reserve asset—a stored commodity that grows with network adoption.

This contrasts with Bitcoin, which simply distributes new coins at a fixed diminishing rate until none remain.

3. Institutional Narrative

A consortium of Ethereum ecosystem leaders (including Danny Ryan, Vivek Raman of Etherealize, Mike Silagadze, William Mougayar, and more—21 authors in total) released the report to provide a cohesive framework for professionals:

Store of value and programmable collateral: ETH isn’t just value storage—it facilitates execution, settlement, and composability.

Institutional-ready narrative: A clear story differentiating ETH from BTC is needed for ETF issuers, family offices, and asset managers. The oil metaphor resonates harder than decentralized jargon.

Data backing: Ethereum secures over 80% of stablecoins, stable usage, and increasing infrastructure build-out—base layer and L2s alike.

4. Price Ranges & Market Comparisons

The report stakes out short-, medium-, and long-term price targets:

Short-term: ETH could reach $8,000.

Next cycle: $80,000.

Long-run: If ETH truly becomes digital economic infrastructure, it could justify market caps in the many trillions, rivaling or exceeding global oil valuations (~$85 trillion).

On June 12, 2025, Ryan S. Adams of Bankless tweeted a chart framing ETH's potential by averaging major asset classes—oil ($85 T), gold ($22 T), global bonds ($141 T), GDP ($106 T), M2 money supply ($93 T)—to reach an $89 trillion target value for ETH, equating to $740,000 per token.

Here’s that link to that tweet for your own review: Ryan S. Adams of Bankless tweet dated June 12, 2025

5. Macro Market Context

As of mid-June 2025, Ethereum trades in the $2,500–$2,800 range, showing resilience despite broader market and geopolitical pressures. A technical pattern—a double‑bottom near $2,500—along with rising institutional interest (including ETFs holding $35+ billion in open interest), reinforces the bullish outlook.

That technical strength coincided with the release of the "Bull Case" report, which emphasizes ETH’s role as core digital infrastructure across institutional sectors and chain interoperability.

6. Debates & Critiques

Is “oil” the right metaphor?

Critics say that as apps move to cheaper layer‑2s, the gas (fuel) demand on Ethereum might decline—so comparing it to oil isn’t perfect. Think of it this way: Ethereum is the main highway, but people are building fast express lanes (Layer‑2s). As long as fees still link back to ETH, the metaphor holds some power—but it's not perfect.Uniqueness questioned:

Other blockchains share similar traits. Yet ETH's defenders argue its scale, security, and integration across applications remain unmatched, making it the most plausible “digital oil” candidate. Critics worry the metaphor plays down these distinctions.Utility vs speculation:

Some users treat ETH purely as a speculative asset, not realizing it “does work” onchain and offchain—until they actually try using it for staking, DeFi, NFTs, etc. The report tries to change that perception: it’s not just a bet, it’s a tool for digital infrastructure.

7. Growth Catalysts & Ecosystem Expansion

Key pillars supporting the thesis:

Layer‑2 stacks: Rollups (Optimism, Arbitrum, Base) are scaling usage while retaining ETH’s security and economic mechanics.

Institutional adoption: Regulation (e.g., ETF frameworks) and clear custodial pathways are unlocking multi-billion-dollar inflows.

Cross‑sector integration: Stablecoins, tokenized real-world assets, decentralized identity, AI compute—all are building on Ethereum.

Deflationary burning: Transactional activity increases burn rates, further reducing net supply.

Stake growth: With over 34.6 million ETH staked, participation in consensus is at record levels.

8. Strategic Implications

For institutions: ETH could complement BTC—not just as a store of value but as a core infrastructure asset, one tied directly to real-world applications. The oil analogy gives it legitimacy and framing for asset allocators.

For developers/users: More engagement with on-chain and off-chain ecosystems could strengthen ETH’s narrative: usage drives fees and burns, which in turn deepen scarcity and value capture.

For crypto markets: A broad narrative shift toward ETH as commodity + collateral + fuel could reshape valuation models away from debt-driven DCF-style token appraisals.

9. Conclusion: A Strategic Repositioning

Rather than a brief messaging play, the "Bull Case" report aims to recenter ETH:

As a commodity of trust and execution—essential for global, permissionless coordination.

As a deflationary, yield-generating asset—a durable reserve layer.

As a cornerstone for institutional participation—driven by narrative, regulation, and infrastructure.

If ETH achieves these goals, it becomes more than a token—it becomes the commodity anchor of a digital civilization, mirroring oil’s central role in the industrial age. Its success depends on usage, institutional adoption, and narrative cohesion.

Don’t blow me up with questions about Ethereum or Bitcoin please. It will take me a lot of time to figure out meaningful answers and I’ve already spent too much time on this the past two days . . .

That is all. Steven